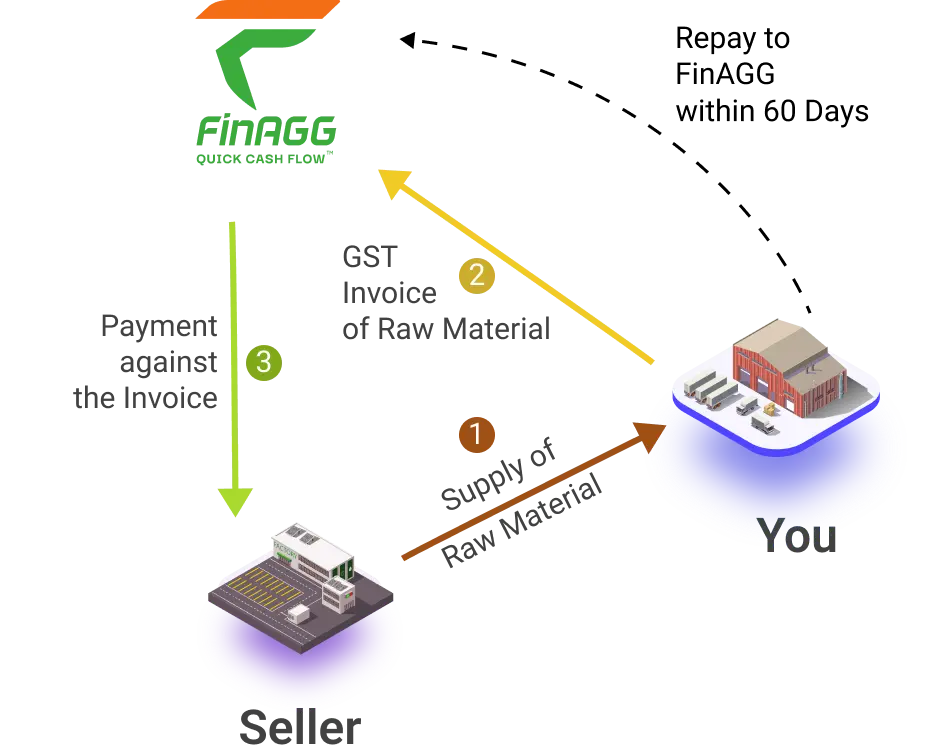

FinAGG is an invoice based financing solution for MSMEs in India. Our Quick Cash Flow product promotes MSME business growth while holding stocks in ample, also widely known as Stock Now Pay Later solution for MSMEs in India.

FREQUENTLY ASKED QUESTIONS (FAQs)

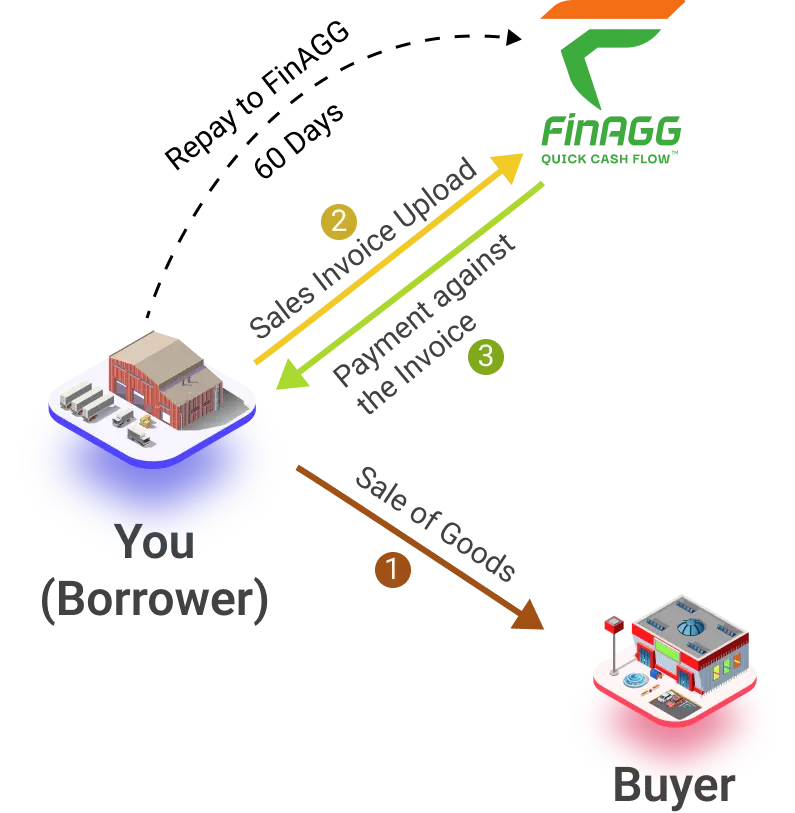

If u r a manufacturer or trader who is regularly supplying to any SME, MSME or Large Corporate, you face cash flow issues at times. FinAGG can provide you immediate finance through its platform, without any physical paperwork.

Those who face liquidity issues & need funds to increase your production. Those who have min 2 yrs of business vintage + min 18 months of GST Bank credits should be more than 80% of their sales on GST

Personal & business KYC 12 Months bank statement

Up to 50 Lakhs.

Finagg will share a unique virtual a/c with you. All payment will be routed through the virtual a/c.

There are 2 ways to repay:

- You can transfer from CC or OD bank to virtual a/c on us before the due date.

- This virtual a/c can be communicated by u to ur buyers against whom we have financed.The moment money is received in the virtual account Finagg system will adjust the invoices financed on a FIFO basis & will refund any excess. Finagg will adjust all payments received on the basis of IPC ( Interest / principal/charges).